Over the past ten to twenty years, co-living arrangements have been emerging worldwide, providing more affordable housing options while catering to evolving lifestyles and values. This trend is now gaining momentum in Australia, presenting a logical choice for novice property investors.

Throughout history, humans have always lived in various communal setups, dating back to the Stone Age where extended families shared shelters. This concept continued through the 20th century with examples such as the kibbutzim in Israel and post-war European “lodging” houses.

Typically it’s Millennials and increasingly Gen Zs who have been spearheading the co-living movement; and given that Millennials are the biggest generation in the world, their preferences will inevitably go a long way in shaping our societies. That said, co-living is becoming more inclusive.

Many over 65s – empty-nester Baby Boomers – are now mortgage free and share the millennials’ desire for more freedom, a variety of life experiences. For others, it’s an economic necessity.

Millennials are not the only segment embracing co-living. Empty nesters and those over 50 enjoy the community aspect of shared living.

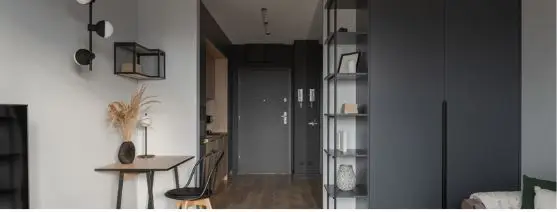

Co-living today generally takes the form of purpose-built housing that mixes fully-furnished rental spaces with a range of communal lifestyle spaces. A co-living unit or “micro-apartment” typically includes a bed, a sitting area, desk, access to a bathroom (private or not) and sometimes, a kitchen/ette.

Rental terms are often more flexible than standard leases, and your monthly rent bill might include a concierge or complex manager, as well as fast internet, utilities and room cleaning. Larger micro-apartment blocks offer shared living spaces, laundry, kitchens – and in some higher-end examples, gyms, swimming pools, roof top terraces and barbecues.

Your co-living complex may also offer entertainment events for residents, and co-working spaces so that work-from-home (WFH) residents don’t have to slog it out alone on the laptop five days a week.

One of the exciting opportunities of co-living is it can be built around the lifestyles and interests of specific residents, i.e., families might share playrooms and child-minding services; artists could take advantage of art/crafting and exhibition spaces; older (and younger) residents could share maintenance of vegie gardens.

The co-living trend has been speaheaded by developers overseas. But in Australia, private investors have the opportunity to earn real positive cash flow through residential home conversions or purpose builds.

The situation overseas

Co-living has been going strong in Europe, the Americas and Asia for decades now. The movement thrives in cosmopolitan areas where rents are high; and where entrepreneurs have the foresight to develop new types of accommodation that meet the changing needs of renters.

In Europe there are a number of different chains offering co-living accommodation, like Quarters, founded in 2012 in Berlin, a city which has battled an affordability crisis for years. Quarters offers individual units in microclusters or studios, combined with shared facilities and smart technology systems. Residents sign on to rent for anywhere from 9 to 36 months.

Habyt is another provider of fully-furnished, fully-serviced micro-apartments and the choice of shared or private living for people in Germany, Spain, Italy, and Portugal. Meanwhile, in Stockholm, Tech Farm offers its “global citizens” access to meditation/yoga rooms, multiple kitchens, cozy living rooms and a home cinema!

In Hong Kong and Singapore, real estate prices are amongst the highest in the world. In Hong Kong, for example, residential property prices have increased by 262% since 2009 and young people there are embracing co-living as an affordable lifestyle choice.

The Lyf chain of co-living residences now has buildings in Japan, Thailand, Singapore and the Philippines – with China and Australia being developed over the next 3 years. Other chains are popping up in the US too.

For those renters keen to see what co-living options are available, the coliving website lets you search for options in the city where you want to live, from New York City to Berlin to Bali.

Micro-apartments, like this one here are much like a studio or one bedroom apartment, complete with a kitchenette, sitting area, sleep area, and ensuite bathroom.

In Australia, 3 key factors are boosting interest in co-living.

It can be difficult to find affordable housing in Australian cities, either because there’s a shortage of rental properties, or because rents are high – or both. In fact, the inability of incomes to keep up with rents is causing rental stress, especially among low-income earners.

Rising home prices also makes the idea of owning property a distant dream for some.

If young people can’t, or don’t want to live at home with their parents, their options are limited. it’s part of a bigger problem: we need to change how we think about “homes” in Australia. And we need to rethink our property investment strategies, especially for beginners.

There are some key factors driving citizens to co-live.

Today, many of us are lucky enough to have access to technology that keeps us connected wherever we go. Countless aspects of our lives are being digitalised, with apps bringing convenience on mobile and our information held in the cloud.

These developments are giving us the flexibility to break free of traditional hierarchies, the 9-to-5 grind and office-based work. Many younger people are choosing to become freelancers, contractors or they’re starting online businesses, with technology enabling them to be location independent and still earn a living. Many employers are facilitating this practice by allowing staff to work remotely, especially since COVID-19.

Overall these new, more fluid ways of working and living mean people can chase career prospects, and live where their salary has more buying power.

Pre COVID, the idea of the “global nomad” was strong with people seeing the world as their playing field and “experience” as the ultimate goal. It’s likely we’ll see this mindset return when the COVID vaccination is universal, international travel resumes and public confidence returns.

In the meantime, Australians are moving interstate and intrastate to explore new experiences.

We’re also seeing the trend of people owning less and having less attachment to “things”, whether vehicles, appliances or houses. The sharing economy phenomenon and peer-to-peer platforms have further disrupted how many of us think about cars, and even about clothes.

In real estate, this has translated into greater demand for rentals, especially among those who are graduating from student accommodation and are used to inhabiting spaces very differently to previous generations. Many are now looking for more openness and collaboration in the spaces they inhabit; they’re more adaptable and willing to share facilities.

Co-living is definitely playing its part in this disruption story.

Co-living also helps support another core value of younger generations and that is sustainability, from keeping carbon emissions down through energy-efficient appliances in kitchens and laundries, to creating less food waste; even just making more efficient use of living spaces and sharing resources and costs.

Many of the developers creating co-living accomodation are making an effort towards sustainable practices, with sustainability an important pillar of their business.

The co-living micro-apartment is a typical custom build solution

There is a downside to the freedom and independence that come with travelling for work or living away from family and friends. People can experience isolation, alienation and a reduction in that essential sense of belonging to a community. These can lead to mental health issues like anxiety and depression.

During COVID, we witnessed WFH employees missing the social interaction that a physical workplace brings. In fact, what we’ve seen is that COVID lockdowns have actually stimulated an interest in co-living, with people reminded how important it is to feel part of a community, to feel connected to others as a way to counteract loneliness and isolation.

As our cities grow, as key societal trends accelerate, as affordability reduces further, the co-living trend is not only becoming more attractive – in the longer term, it will become a necessity. This presents an opportunity for property investors willing to try alternatives to mainstream housing options of the past.

And you don’t need to be a major developer or even an experienced investor to become part of the movement. As a property investment option for beginners, creating co-living spaces can provide positive cashflow, healthy capital growth and help you pay off your property faster.

Co-living is a modern housing concept where individuals rent private living spaces (e.g., micro-apartments) within a larger, purpose-built community. These spaces often include shared amenities like kitchens, gyms, coworking areas, and communal lounges. Co-living is designed to provide affordable, flexible, and community-oriented living solutions.

Co-living appeals to a wide range of individuals, including:

Millennials and Gen Z: Drawn by affordability, flexibility, and shared experiences.

Empty nesters and Baby Boomers: Seeking community and variety in life experiences.

Remote workers and digital nomads: Attracted to coworking spaces and location independence.

Co-living spaces include:

Fully furnished private units with essentials like a bed, desk, and kitchenette.

Shared amenities such as gyms, coworking spaces, and laundry facilities.

Flexible rental terms often covering utilities, internet, and cleaning services.

Some complexes even host social and entertainment events to foster community connections.

Co-living provides:

Flexible rental agreements, often shorter than standard leases.

All-inclusive pricing for utilities, internet, and other services.

Access to shared spaces and social events, fostering community engagement.

Co-living offers property investors:

Positive cash flow: High rental demand and shared costs make co-living profitable.

Capital growth potential: Rising urban populations and housing shortages drive value.

Scalability: Start small with home conversions or purpose-built projects.

Yes! Co-living is an excellent entry point for novice property investors. Whether through residential conversions or purpose-built developments, investors can tap into this growing market and benefit from consistent rental income.

Co-living properties provide:

Affordability compared to traditional rentals.

Fully furnished, modern living spaces with shared amenities.

Opportunities for social interaction and networking.

Flexible rental terms that suit transient or independent lifestyles.

Inquire below by booking a FREE discovery Call and a member of our will contact you.

Yes, co-living supports sustainability by:

Using energy-efficient appliances.

Reducing carbon footprints through shared resources.

Encouraging waste reduction and efficient space usage.

Many co-living developers prioritize sustainable practices as part of their designs.

Three key factors are driving the growth of co-living:

Affordability: Rising rents and home prices make co-living a cost-effective solution.

Lifestyle Shifts: Flexible careers, a focus on experiences over ownership, and a preference for community living are reshaping housing preferences.

Community Building: Co-living addresses the isolation often felt in traditional housing setups, offering social interaction and a sense of belonging.

August 9, 2023

August 9, 2023

September 20, 2023

March 10, 2024

September 20, 2023

January 28, 2025

All contents published on this website or otherwise made available by TPG Property Group Pty Ltd to you is general information only and is intended to help you in understanding the products and services offered by TPG Property Group Pty Ltd. The information does not take into considerations of any particular investment objectives or financial situation of any potential reader. It does not constitute, and should not be relied on as, financial, investment, legal or any other professional advice or recommendations both expressed or implied. It should not be used as an invitation to take up any investments or investment services. You are advised to do your own due diligence when it comes to making financial and investment decisions and should use caution and seek the advice of qualified professionals such as accountant, lawyer, or other professional advisors before acting on this or any information. TPG Property Group Pty Ltd, its employees or contractors do not represent or guarantee that the information is accurate or free from errors or omissions and therefore provide no warranties or guarantees. You may not consider any examples, documents, or other content on the website or otherwise provided by us to be the equivalent of professional advice. Nothing contained on the website or in materials available for download on the website provides professional advice in any way. TPG Property Group Pty Ltd disclaims any and all duty of care and liability and assumes no responsibility for and you will indemnify TPG Property Group Pty Ltd against any losses or damages resulting from your use of any link, information, or opportunity contained within the website or any information within it.