From the perspective of a real estate developer, the potential return on investment per square meter is just not feasible.

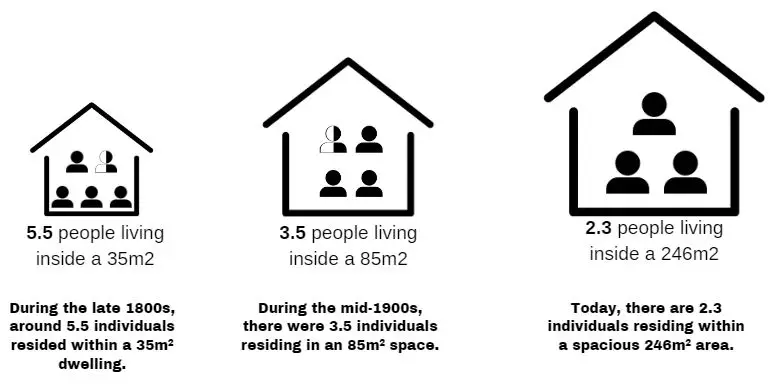

To put this into context, if you had 246m2 in Hong Kong, you would be able to fit just over 22 homes for the same space here in Australia. Using that same logic, a home of 246m2 could fit 55 people inside it.

Considering the reliability of a family as a tenant, the typical duration of occupancy in a regular family residence ranges from 6 to 12 months, whereas for individuals who are single or in a couple, it extends to 2 years. As a result of the oversupply of family homes, families have more choice whereas someone on their own stay longer because they know their options are limited. There is a massive undersupply of affordable dwellings designed to cater for single people.

As we prepare to sleep tonight, there exist twelve million unoccupied bedrooms throughout the nation, while simultaneously, 116,000 homeless individuals are sleeping in vulnerable conditions. This is not the typical assumption most Australian have around someone who is homeless but people who sleep in their cars, couch surf, temporarily in caravan parks etc. The fastest demographic of homelessness in Australian is women over the age of 55, be it through no fault of their own but merely unfortunate circumstantial outcomes.

We live way to big in Australia, and this lack of affordability is evident in the escalating homelessness rate. From 2011 to 2016, homelessness increased by 15%. 1 in 200 people are classified as either Primary, Secondary or Tertiary homeless in Australia. These statistics correlate with the rising prices of housing.

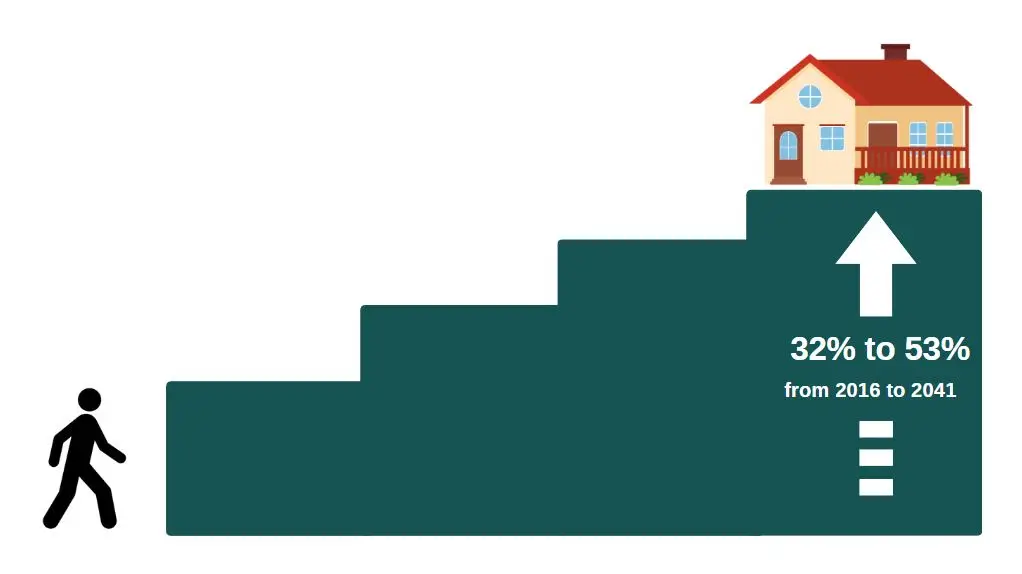

Individuals who reside alone allocate an average of 44.4% of their income towards housing expenses. The established Australian threshold for housing affordability is breached when housing costs surpass 30% of an individual’s earnings.Projections show that people living on their own will make up 24% to 27% of all Australian households in 2041 (compared to 25% in 2016) and increase by between 0.7 and 1.2 million (32% to 53%) from 2016 to 2041.

When looking at the average rent of a 4 bedroom home as per the Department of Health & Human Services Rental Report, we see it costs $420, whereas avg price of 2bed home is $415. Therefore each extra bedroom is worth $2.50 per week, on average.

This raises the question: Why do most investors continue to construct four-bedroom residences? The return on investment is clearly not viable.

Social isolation and feelings of loneliness exhibit variations across different age demographics. Loneliness tends to be more common among young adults, males, individuals living alone, and those with children, either as single parents or in couples. The Australian property market is catered and modelled for the majority around families – the least likely group to experience social isolation and loneliness.

1 in 10 (9.5%, or around 1.8 million based on 2016 population) Australians aged 15 and over report lacking social support (Relationships Australia 2018)

about 1 in 4 report they are currently experiencing an episode of loneliness (Australian Psychological Society 2018)

1 in 2 (51%) report they feel lonely for at least 1 day each week (Australian Psychological Society 2018).

For people who live by themselves, very little housing options allow for social connections that produce positive outcomes.

August 9, 2023

September 20, 2023

March 10, 2024

August 21, 2024

All contents published on this website or otherwise made available by TPG Property Group Pty Ltd to you is general information only and is intended to help you in understanding the products and services offered by TPG Property Group Pty Ltd. The information does not take into considerations of any particular investment objectives or financial situation of any potential reader. It does not constitute, and should not be relied on as, financial, investment, legal or any other professional advice or recommendations both expressed or implied. It should not be used as an invitation to take up any investments or investment services. You are advised to do your own due diligence when it comes to making financial and investment decisions and should use caution and seek the advice of qualified professionals such as accountant, lawyer, or other professional advisors before acting on this or any information. TPG Property Group Pty Ltd, its employees or contractors do not represent or guarantee that the information is accurate or free from errors or omissions and therefore provide no warranties or guarantees. You may not consider any examples, documents, or other content on the website or otherwise provided by us to be the equivalent of professional advice. Nothing contained on the website or in materials available for download on the website provides professional advice in any way. TPG Property Group Pty Ltd disclaims any and all duty of care and liability and assumes no responsibility for and you will indemnify TPG Property Group Pty Ltd against any losses or damages resulting from your use of any link, information, or opportunity contained within the website or any information within it.