First Home Buyer Guidance

Step by step help with grants, finance and floor plans, move into your first home sooner.

Co-living real estate investments have surfaced as a profitable choice for investors pursuing stability and financial gains in recent times.

We delve into what Coliving encompasses, its benefits and drawbacks, financing opportunities, and how to commence this promising investment venture.

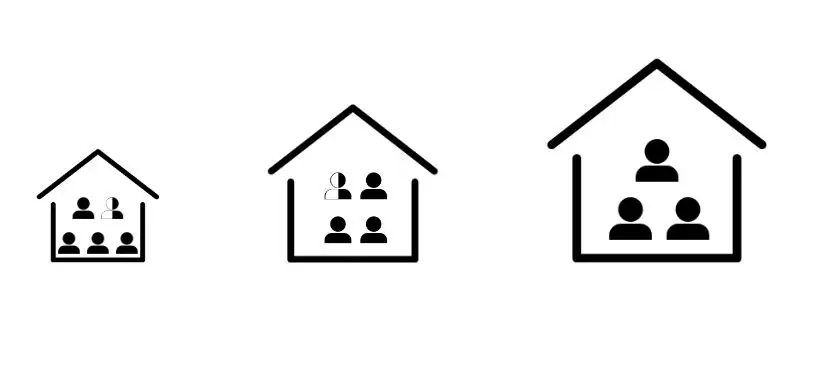

Co-living arrangements permit individual tenancies within a single property. They generally feature private bedrooms and bathrooms in addition to shared communal spaces. Examples encompass accommodations for international students and residences tailored for contract or FIFO workers.

Coliving is an attractive investment option, particularly in the current high-interest-rate climate, these properties exhibit exceptionally strong positive gearing. Consequently, after covering all expenses and mortgages, owners could potentially earn $20,000-40,000 annually. In contrast, a standard property in this economic situation may yield nothing.

In contrast to conventional residential investments, co-living calculates rent based on individual rooms, which can yield significant profits.

Co-living mortgage options exhibit several distinct differences compared to traditional home loans.

Certain lenders evaluate lending based on the anticipated rental market value. Even if your co-living property has the potential to generate $1500 weekly, a major lender might hesitate, considering the similar rates in the neighbourhood. Thus, the lender must be comfortable with financing this type of investment property.

Specialized lenders will conduct a commercial appraisal of the property. While the loan remains classified as residential, a commercial valuation, which typically costs around $3,000, is required for the owner, the borrower.

Based on this valuation, the lender will determine the expected rent for a co-living property, which is typically significantly higher than standard rentals.

Despite the differences, co-living property loans offer standard mortgage features like digital banking and offset accounts.

An 80% Loan-to-value (LVR) ratio is expected for this type of loan.

Co-living properties present an appealing investment opportunity due to their strong positive gearing, which sets them apart from numerous residential investments during periods of high interest rates.

Co-living properties can also provide stability regarding tenant vacancies. If a tenant leaves a co-living property, you can still receive rent from the remaining tenants, unlike in a standard rental property where it would remain vacant.

Moreover, if you depend on property income for mortgage serviceability, specialized lenders may recognize a significantly higher co-living income compared to traditional lenders who only acknowledge a market value.

Like any investment, co-living property investment has potential drawbacks, particularly concerning property management and utility insurance.

If you don’t enlist a competent property manager experienced in accommodating multiple tenants and the heightened demands it entails, this could pose an issue. Therefore, selecting a proficient property manager is essential.

Additionally, these properties typically come fully furnished with utilities included. Consequently, as a property investor, you may need to arrange water, gas, and electricity connections.

Moreover, co-living properties entail higher insurance requirements compared to standard rentals.

This is due to insurance prerequisites and unrelated residential occupants. Therefore, insurance premiums for these properties may be higher and subject to different conditions.

The typical approach for investing in co-living properties involves engaging a builder who specializes in co-living accommodations.

Although it’s feasible to purchase existing co-living properties, they are less readily available.

Subsequently, you’ll need to identify the appropriate lender. An experienced consultant from TPG Property Group can assist you with this, simplifying the process.

Co-living investments often prove to be remarkably cost-effective when compared to conventional residential properties.

These properties generally attract individuals seeking to diversify their property investment portfolio while benefiting from a high-income investment.

The typical approach for investing in co-living properties involves engaging a builder who specializes in co-living accommodations.

Although it’s feasible to purchase existing co-living properties, they are less readily available.

Subsequently, you’ll need to identify the appropriate lender. An experienced consultant from TPG Property Group can assist you with this, simplifying the process.

Co-living investments often prove to be remarkably cost-effective when compared to conventional residential properties.

These properties generally attract individuals seeking to diversify their property investment portfolio while benefiting from a high-income investment.

Investing in co-living properties is feasible through a self-managed super fund (SMSF).

This type of loan can also be utilized within an SMSF. However, the key distinction lies in the fact that an SMSF prohibits the purchase and renovation of an existing property; it must be a new build.

August 9, 2023

August 9, 2023

September 20, 2023

August 21, 2024

Our Services

TPG Property Group supports Melbourne and Australia wide clients with land selection, finance, turnkey builds and long term strategy.

Step by step help with grants, finance and floor plans, move into your first home sooner.

Strategies for high growth suburbs, tax benefits and SMSF options that build wealth.

Low deposit options and competitive loans, with expert lender support and faster approvals.

Fixed price turnkey homes in Melbourne and Australia, fully finished and ready to move in.

Secure land in Melbourne growth areas, matched to your budget and lifestyle goals.

Stay in the suburb you love and upgrade to a modern, efficient new home.

Quality multi dwelling projects for lifestyle appeal and strong rental returns.

We manage design, permits, construction and handover, on time and on budget.

Trusted partners streamline contracts, settlements and loan approvals.

Data led suburb insights and feasibility reviews for smarter decisions.

Plan, acquire and manage a long term portfolio that grows with you.

All contents published on this website or otherwise made available by TPG Property Group Pty Ltd to you is general information only and is intended to help you in understanding the products and services offered by TPG Property Group Pty Ltd. The information does not take into considerations of any particular investment objectives or financial situation of any potential reader. It does not constitute, and should not be relied on as, financial, investment, legal or any other professional advice or recommendations both expressed or implied. It should not be used as an invitation to take up any investments or investment services. You are advised to do your own due diligence when it comes to making financial and investment decisions and should use caution and seek the advice of qualified professionals such as accountant, lawyer, or other professional advisors before acting on this or any information. TPG Property Group Pty Ltd, its employees or contractors do not represent or guarantee that the information is accurate or free from errors or omissions and therefore provide no warranties or guarantees. You may not consider any examples, documents, or other content on the website or otherwise provided by us to be the equivalent of professional advice. Nothing contained on the website or in materials available for download on the website provides professional advice in any way. TPG Property Group Pty Ltd disclaims any and all duty of care and liability and assumes no responsibility for and you will indemnify TPG Property Group Pty Ltd against any losses or damages resulting from your use of any link, information, or opportunity contained within the website or any information within it.